RightTrak Empowers Learners with a Lifetime of Healthy Financial Habits

It’s an enjoyable and engaging financial education program designed by TFO Wealth Partners to get students and young adults on the “right trak” to understanding the fundamental foundations of wealth.

Many obstacles are standing in the way of American’s reaching their long-term financial goals.

Credit card debt, student debt, and spending more than what’s being earned, just to name a few. We believe the underlying problem is a lack of financial understanding and education that should be learned early in life.

The Results Of These Missing Skills Are Staggeing

Source: Northwestern Mutual Planning and Progress Study 2020

69%

Of Americans have less than $1,000 in personal savings.

1 in 5

Americans reported they have less than $5,000 saved for their retirement years.

45%

Of Americans say they have $0 in personal savings.

15%

Of U.S. adults reported they have $0 saved for their retirement years.

1 in 3

Nearly 33% of Americans are living paycheck to paycheck.

$5,400

The average amount of credit card debt among U.S. households.

3 in 10

Nearly 3 in 10 U.S. adults have no emergency fund created.

$24,155

The average amount of student debt adults carry coming out of college.

RightTrak Makes Financial Learning Fun!

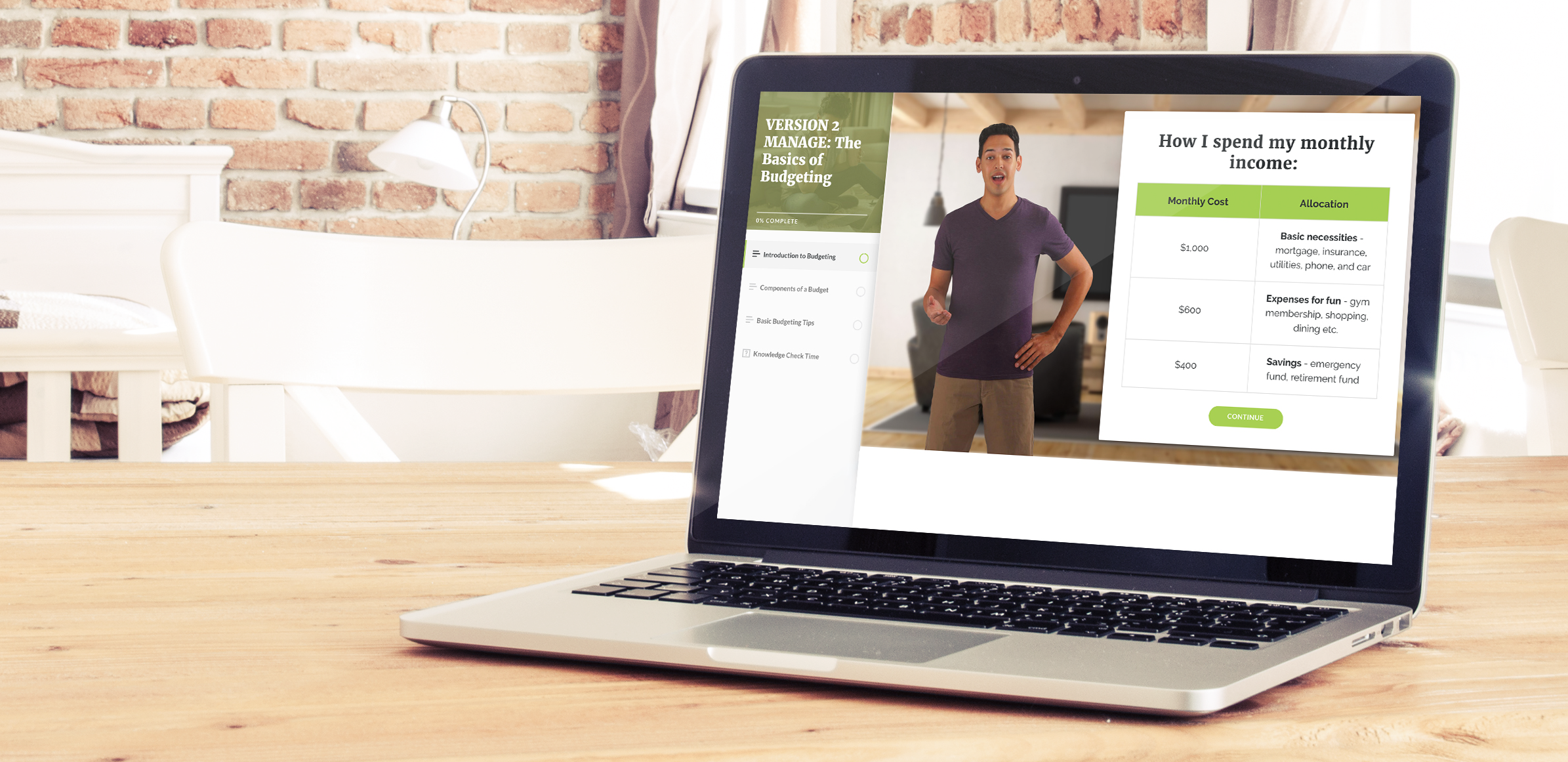

We believe financial learning should be easy, fun, and engaging. RightTrak makes the complex simple and enjoyable through a customized learning experience, including games, assignments, videos, quizzes, scenarios, and more. Learn the essentials of spending, saving, budgeting, investing, and more through a beautiful user experience that can be taken anytime, anywhere.

A customized financial learning curriculum built with you in mind.

Our core curriculum concentrates on the four fundamental foundations of wealth we believe are critical to developing good financial habits. By learning and living these lessons, students can get on the “right trak” to a bright financial future.

The RightTrak Foundational Four.

Four Tracks to Get You on the “Right Trak.”

-

Trak 1: MANAGE

Before building wealth, one must first have a firm understanding of how to manage it. Our MANAGE Trak will tackle the basics of budgeting, banking, borrowing, credit cards, the importance of saving, and opportunity cost.

-

Trak 2: PROTECT

Protecting what you’ve worked for is just as important as building it. Our PROTECT Trak will handle life insurance, disability insurance, property & casualty insurance, workplace benefits, and cybersecurity.

-

Trak 3: GROW

Our GROW Trak will cover all things investing and how to make your money work for you. These include types of investment accounts, why one should invest, types of securities, compound interest, and much more.

-

Track 4: SHARE

Our SHARE Trak will highlight various strategies to pass on wealth to family and charities successfully. These strategies include taxes, key estate planning tools, and the importance of philanthropic giving.

“We believe the obstacle preventing many Americans from reaching their financial goals is a lack of financial education and understanding. RightTrak helps make learning these fundamentals at an early age easy and engaging, helping set the stage for a lifetime of financial independence and success.”

— Your RightTrak Team

Have Questions?

If you have any trouble with your enrollment or have questions on any element of the learning curriculum, please don’t hesitate to reach out to Matt Lopes who can help provide a solution.